As we near the end of may 2021, the cryptocurrency landscape has undergone significant turbulence, prompting many to wonder about the future of trading. With the recent market dump, is it all over, or is there still potential for profit in these uncertain times? In this post, we’ll explore what traders can expect moving forward and whether fear should dictate our actions.

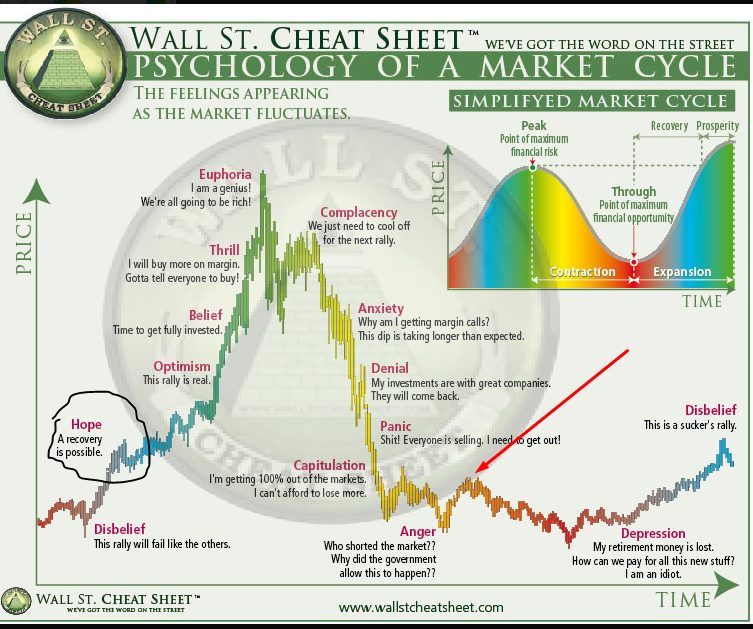

Current Market Sentiments and Future Outlook The recent downturn has undoubtedly shaken the confidence of many investors, but as history and the Wall St. Cheat Sheet suggest, markets are cyclical. Emotions drive the market through predictable phases of optimism, thrill, euphoria, and eventually fear, which often leads to sell-offs. Understanding this cycle can provide insights into what might come next.

We all have the question..

Is Trading Still Viable?

Strategies to Consider:

- Risk Management: More than ever, it’s crucial to implement stringent risk management techniques to safeguard your investments.

- Market Research: Stay informed about global economic indicators and crypto-specific news that can affect market sentiment.

- Diversification: Consider diversifying your portfolio to reduce risk and increase potential for gains across different assets.

Looking Ahead While the market’s current state may seem grim, it’s essential to remember that after every downturn, there is potential for a rebound. Trading isn’t just about riding the highs but also about navigating the lows effectively.

Final Thoughts Fear is a natural response to uncertainty, but in the world of trading, it can be an impediment to success. Educate yourself, prepare your strategies, and remember that volatility can be a trader’s ally if approached correctly.

This is only for social entertainment, I share my findings but do always your own research. I m not a financial advisor!